Woke up from a little nap this afternoon and discovered that the lights were off in the kitchen. I figured that maybe, unbeknownst to me, the lights were on some sort of motion detector. Upon closer inspection… I discovered that all the electricity in the unit was out. The hall was fully powered. But none of us had electric in our units. No one seems very worried. So, I am not worried either.

As for taxes. Box 13 on the 1099-INT may just drive me to a CPA.

Box 13. For a tax-exempt covered security, shows the amount of premium amortization allocable to the interest payment(s). If an amount is not reported in this box for a tax-exempt covered security acquired at a premium, the payer has reported a net amount of interest in box 8 or 9, whichever is applicable. If the amount in this box is greater than the amount of interest paid on the tax-exempt covered security, the excess is a nondeductible loss. See Regulations section 1.171-2(a)(4)(ii).

Yeah right. It is a new box. And, I am not sure that TurboTax is doing it correctly. That was causing my issue with the VA taxes.

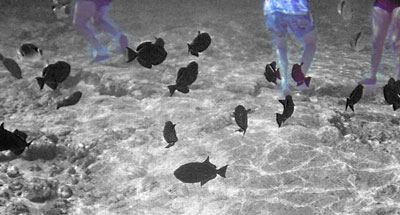

About the picture: Since I am powerless at the instant – I picked this one off the server. It is a poor fish picture from 2001 – but I like all the people – who a clueless about the fish right under their feet. There is a lesson there.